Insolvency

The lifespan of a modular company is ______?

In 2019, Thetford, the quaint market town in Norfolk, made an unusual investment: a £1,600 insurance policy against potential extremist attacks. Local farmer Mark Maloy remarked that there was “more chance of being kicked to death by butterflies than a terrorist attack.” Despite the apparent absurdity, town clerk Tina Cunnell defended the insurance, claiming it was necessary due to the numerous large events held in the area.

This decision is likely to have been influenced by availability bias – the tendency to assess the relative importance of issues based on how easily they come to mind. This is not a phenomenon exclusive to Thetford council. Renowned German psychologist, Gerd Gigerenzer observed a similar trend after the tragic events of 9/11. Many Americans, haunted by vivid images of the disaster, opted to drive cross-country rather than fly. This decision, skewed by availability bias, inadvertently led to an increase in car accidents as the perceived risk of air travel was grossly overestimated.

The human tendency to be swayed by perception over data is particularly evident in the field of modern methods of construction (MMC). MMC has often been accompanied by an idiosyncratic agenda about aesthetic, not helped by childhood memories of prefabricated classrooms. Similarly, the mention of ‘standardisation’ as part of the narrative around product platforms has sparked concerns that our future homes and built environment will be devoid of vernacular charm. Despite our best efforts at Akerlof to demonstrate that MMC is not anathema to character and beauty, our voice has struggled to reach the ears of popular opinion.

More recently, the perception of insolvency risk has become a key issue, particularly for Category 1 MMC (volumetric / 3D structural systems). Headlines within the last 18 months have painted a grim picture, reporting the demise of several modular providers, including Caledonian, Urban Splash, Eco Modular, L&G Modular and now more recently, Ilke Homes. These articles have underscored the financial challenges faced by modular providers in funding high capital overheads amidst volatile economic conditions and uncertainty in future pipelines.

While clients are understandably cautious, it is important to question the extent to which these headlines reflect the true risk.

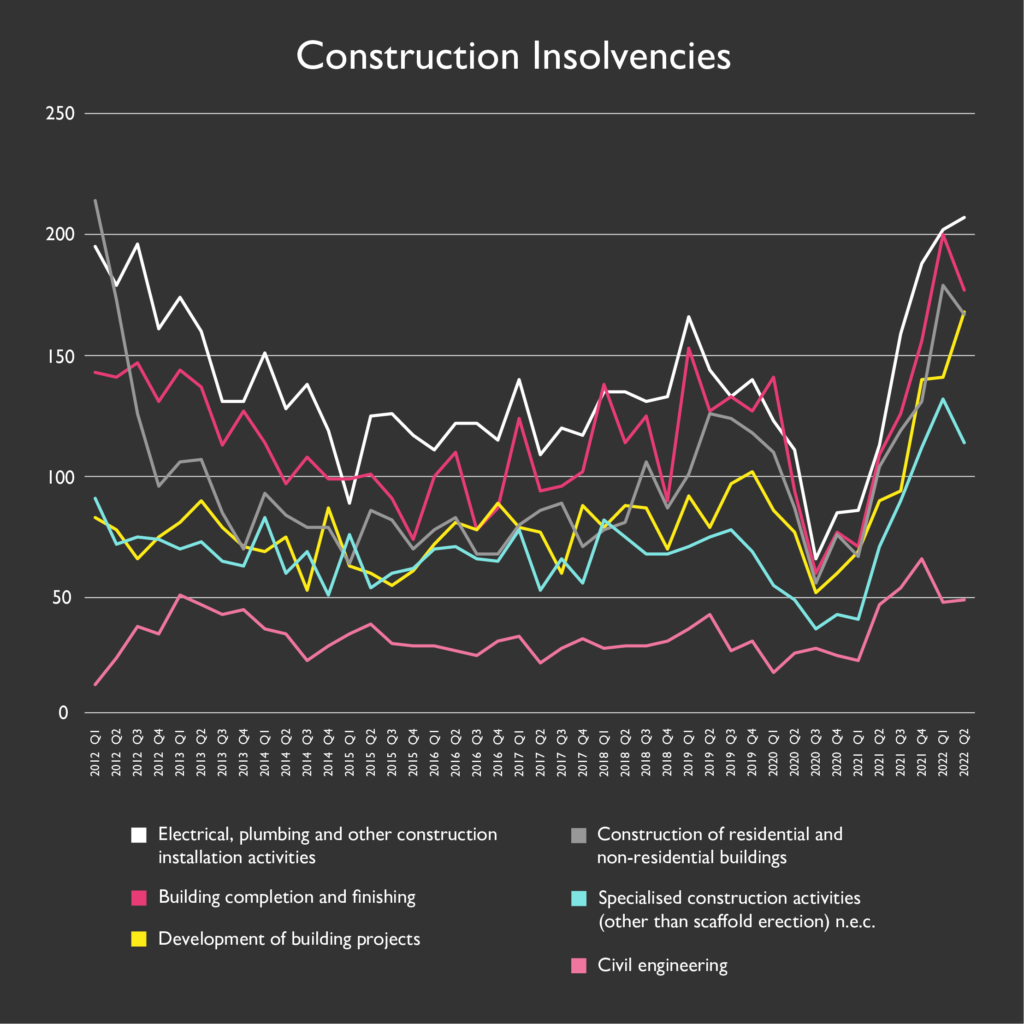

Statistically, the probability of a modular provider going under is less than many other parts of the market. The average age of a modular company is 16.1 years and while 21 businesses have gone into administration in the past 3 years, this represents less than 2.5% of recorded construction business failures. By comparison, 84 times as many M&E businesses have gone under in the same period.

It is also important to recognise success stories within the sector. Despite challenging economic conditions, some organisations such as Darwin, REDS10, Beattie Passive and Algeco have continued to go from strength to strength. Whilst there are risks, there are also opportunities and potential for growth.

Nonetheless, two critical considerations remain:

1. The broader construction industry has seen an increase in insolvency due to macro-economic uncertainty, and a resultant dampening in confidence and fluctuations in pipeline. Volatility in commodity markets, increases in raw materials, challenges within supply market and rising labour costs and financing rates have further exacerbated these issues.

The Insolvency Service reported in 2022 that the construction industry had the highest number of insolvencies of any sector in England and Wales, accounting for 19% of all company insolvencies. The first half of 2023 has continued this trend.

Figure 1: Data from Insolvency Service. The last 12 months have seen a spike in insolvencies – with M&E, building finishes and developers representing 59% of all insolvencies.

2. The impact of replacing the critical work packages, to which MMC solutions often relate, can be significant. The potential pain of having to replace elements with designs that are perceived as bespoke, and long lead-ins can easily overshadow the prospective benefits.

But there are ways to mitigate these risks. Common design solutions across portfolios, through a platform-based approach, is one method. Demonstrated within the Hub’s Value of Platforms publication, there is potential for this approach to be driven by both clients and the market, in creating solutions that are interchangeable and thus retain a lower risk profile.

In this challenging current economic climate, the construction industry faces unique obstacles. For some, the adoption of modular and MMC more broadly has become a strategic decision and calculated risk. Equally, MMC is not a panacea nor appropriate in all circumstances.

Instead, it should be applied strategically, to deliver defined value and outcomes, where the context and risk profile has been evaluated and deemed appropriate. This requires an informed approach… in which case, possibly not a job for Thetford council.