R&D Tax Credits

DURING THE LATE 1970s and early 1980s, Bill Werbeniuk was one of professional snooker’s most renowned figures. Nicknamed ‘Big Bill’ – he was the first man to split his trousers during a televised match – and consuming between 40 to 50 pints a day, he was prominent character of the game.

Suffering from a hereditary nervous disease, Bill’s habit of ‘downing at least six pints before a match and then one pint for each frame’ was medically certified; in turn, the envy of every armchair viewer when it was explained that he could offset the cost of beer against his income tax.

The qualification for tax relief is rarely so colourful as Bill’s tale. However the potential opportunity missed within UK construction sector is a far more important story.

A key aim of the Construction Sector Deal was to increase spending on Research and Development (R&D) in the sector to stimulate innovation. The House of Lords Select Committee review into offsite construction advocated that:

HMRC should work with the [offsite] sector to foster greater understanding of how R&D tax credits work, what the benefits are and how to meet the criteria to receive them.

The same review identified that wider use of R&D tax credits could help increase spending on R&D. Government statistics show that the construction industry has been slow to recognise its participation in conducting R&D. With perception of R&D often governed by stereotypes, construction firms can be blind to how development of bespoke solutions, realising technological advances and resolving uncertainty could constitute qualifying expenditure. It is all too easy to be blind to the accomplishments of our industry and how the professionals within it address complex challenges that demand innovative and unique solutions.

However this position has begun to shift:-

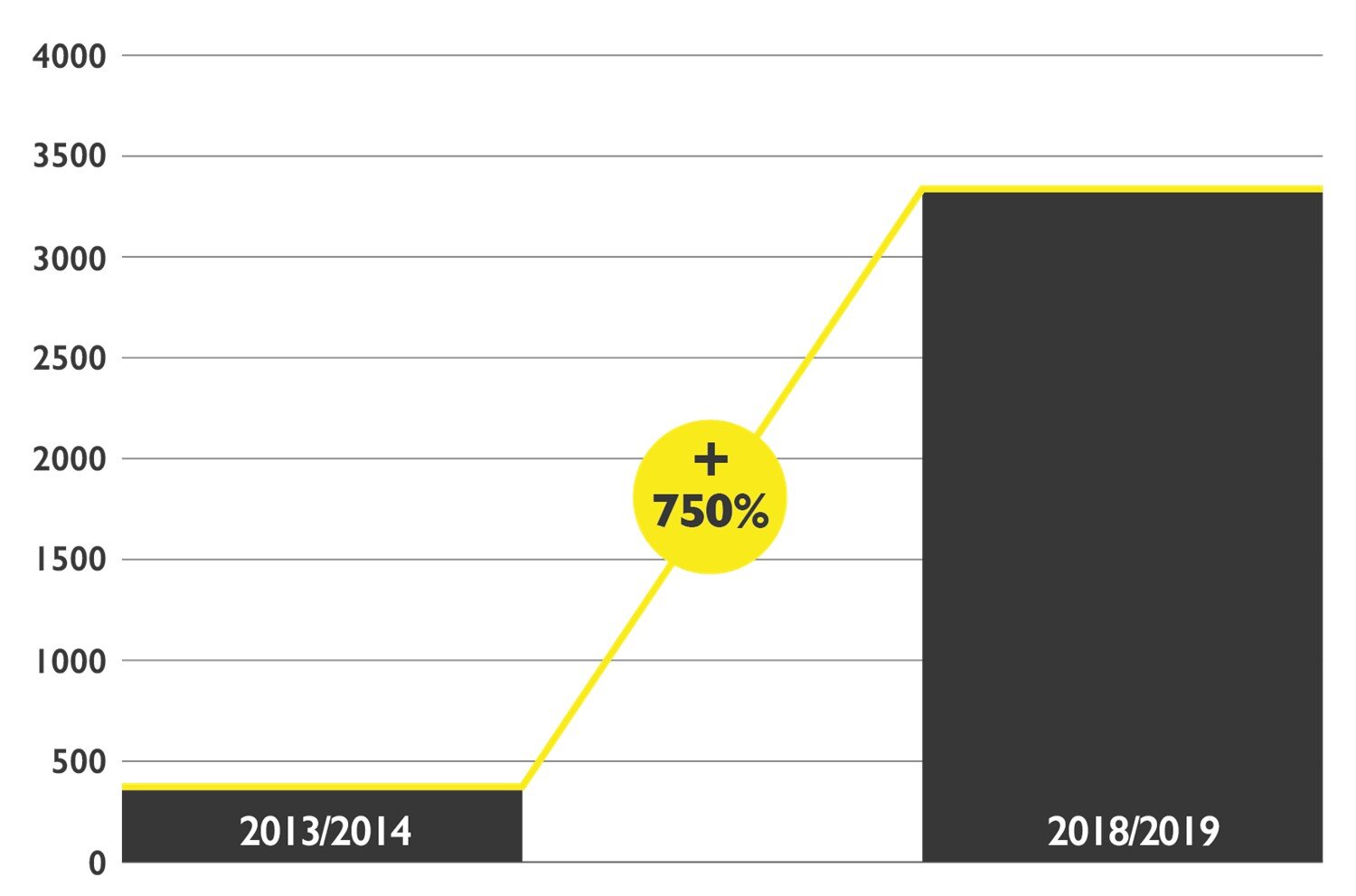

Since 2013/14 claims have increased by 750%. Prior data suggested that only 3% of SMEs and large organisations had put forward claims in the year 13/14; the latest statistics show that this is now up to 30%*.

With an industry gravitating towards the adoption of Modern Methods of Construction (MMC), this trend is expected to continue. In lobbying for fiscal incentives, some have proposed that:

R&D should be recognised as an inherent and critical part of offsite to maximise the potential of the sector and its positive impact on the wider construction industry.

Whilst this inherent position is not recognised under HMRC’s definitions, it is not to say the potential for qualifying expenditure does not exist. For SMEs this can be as significant as 25p/£1, with qualifying expenditure including staff and external work costs, software licenses, certain consumables, and subcontracted R&D.

As experts in MMC, Akerlof supports its clients by providing clarity, intelligence, and insight into how businesses can apply modern methods to realise their business objectives. Identifying the potential qualifying expenditure and supplying you with experts that can support your claim, is a service we provide FREE.

We want to support those invested to deliver better outcomes. Credit for innovation, not just beer money for Bill.

*Data pool excluding micro SMEs and individual contractors.